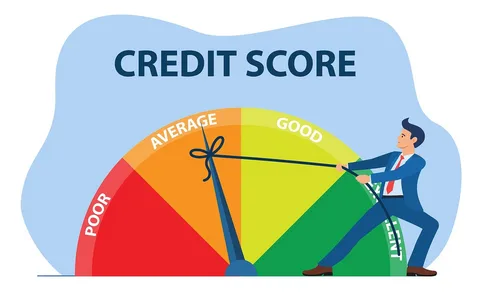

A credit score is a numerical rating that shows lenders how likely you are to pay back debt. It can be used to evaluate mortgages, auto loans, and other credit products.

Getting a perfect 900 credit score can be impressive, but it’s also not guaranteed. And it can take a long time to achieve.

How to get a 900 credit score

Getting a 900 credit score is a goal of many people, but it’s not always realistic. While a perfect score isn’t something that can be achieved in one shot, there are some steps you can take to improve your credit and reach the 900 level.

According to New England Federal Credit Union, a good credit score is key to obtaining various loans and credits, including mortgages, automobile loans, and personal loans. It helps you qualify for competitive interest rates, which can save you money in the long run.

To achieve a 900 credit score, you must be committed to building a solid financial foundation. This can include paying your bills on time, reducing debt, and keeping your credit utilization ratio low.

You should also be sure to have a mix of different credit accounts, including revolving and installment types. This is an important aspect of your credit score, and a mix of different types of accounts shows you have good financial habits and can manage your finances in the future.

In addition to maintaining a solid credit history, you must keep your balances low and pay your credit cards full each month. This can be difficult, especially if you’re trying to pay off a large debt, but it will help your credit score and make you less of a risk to lenders.

It’s also a good idea to keep your credit inquiries under control, as they can lower your score by one or more points. This is particularly important if you’re looking to purchase a home or a car, as these are the most likely places where you’ll need a credit score above 800.

Another thing to consider is your credit mix, which makes up 10% of your score. It’s a good idea to have a variety of different types of accounts, but it’s not a good idea to carry a lot of debt on multiple credit cards or loans.

If you’re able to achieve a 900 credit score, you’ll have a much easier time buying a home and getting the best interest rates on loans. You’ll also be able to take advantage of some of the most lucrative credit card offers, which can help you get the most out of your lifestyle.

What you need to do to get a 900 credit score

Your credit score is one of the most important factors in determining how much you pay for loans and whether you qualify for mortgages, auto, and home insurance. A good credit score can also help you save money in the long run.

Your score is based on a number of different factors, including your payment history, how much debt you have, and your credit utilization ratio. The higher your score, the more likely you will get approved for a loan or a credit card at a low interest rate.

In order to improve your credit, you need to be consistent with your financial habits and practice wise debt management strategies. This means paying your bills on time, keeping your balances low, and avoiding taking out new credit you cannot repay.

Having a mix of different types of accounts is also beneficial, as lenders like to see that you have both revolving and installment loans. This includes credit cards and lines of credit, as well as car loans, mortgages, personal loans, and other forms of credit.

A credit mix is a positive factor in a credit score because it indicates that you’re responsible for your finances. But be careful, as having too many accounts can hurt your credit rating, so make sure to keep a balanced mix of them.

The best way to build a 900 credit score is to pay your bills on time and keep your credit utilization low. You can do this by focusing on minimizing your outstanding debt and using less than 30% of your available credit.

You can also increase your credit limit and set up balance alerts to monitor your credit usage and help you stay within a healthy credit utilization ratio. By following these steps, you can improve your credit and raise your score in no time.

Getting a 900 credit score is not impossible but will take time and effort. It’s important to remember that building a great credit history takes years of consistent credit behavior. But it’s possible to reach a perfect score, and it can also be very rewarding once you achieve it.

How long it will take to get a 900 credit score

A 900 credit score is possible, but getting there will take some work and patience. It will also depend on your current financial habits and credit history.

The best thing to do if you want to improve your credit is to make sure that you pay all of your bills on time and keep your debt-to-credit ratio low. By doing these things, you’ll be able to raise your credit score and improve your chances of getting approval on new loans and credit cards.

You can start by checking your credit report for free at WalletHub to see your credit score. A reputable credit repair company can also help you increase your score.

Once your score is up, you should be able to get approved for most loans with reasonable interest rates. However, your lender will likely look at the other factors on your credit report to determine if they can give you the loan you need.

A good credit score is important because it can affect the amount of money you spend and your overall lifestyle. It can also prevent you from paying more for a car or home than you can afford.

It can also allow you to negotiate better terms on your loans and credit cards. Having a good credit score can also reduce your insurance costs, saving you a lot of money over your life.

In order to reach a credit score of 900, you will need to be responsible for your finances and have a consistent track record of on-time payments. You should also try to keep your credit utilization ratio low and avoid opening new lines of credit.

Your current financial situation could take you a few months or several years to improve your credit score. But if you’re willing to put in the time and effort, it could be well worth it in the long run.

Ideally, you should aim for a score of 700 or above to qualify for a mortgage or other major loans and a good rate on your credit cards. A higher credit score can also help you to save money in the long run, which will be beneficial if you plan on buying a house someday.

How you can get a 900 credit score

A credit score is a three-digit number that reflects your credit risk, the likelihood that you will pay off your debts on time. It is a key factor when applying for mortgages, cars, and credit cards, and it helps determine your interest rate.

A good credit score will help you get the most out of your money and ensure you can afford to live comfortably. If you have a high credit score, lenders will likely grant you loans with favorable terms and interest rates.

Getting a 900 credit score is not easy, but it’s possible if you follow a few simple steps. The first step is to ensure that your credit report is accurate and error-free. You can do this by looking over your reports and filing a dispute when there are any errors.

Another way to improve your credit is by keeping a low balance on your cards and lines of credit. This can help you avoid paying extra interest on your cards and reduce your credit utilization ratio, which makes up 30% of your FICO(r) Score.

You can also keep a low number of recent inquiries on your credit report. This is important because inquiries can damage your score by one to five points.

The other key to getting a 900 credit score is paying your bills on time, keeping your credit utilization ratio low, and avoiding opening new accounts. These are all easy things to do and can help you raise your credit score and qualify for better loan terms.

A credit score of 900 is a goal that many people have, but it’s not always realistic. In fact, only 1% of the population has a credit score of 850 or higher.

However, it is still a desirable financial goal and a good thing to work toward. A perfect credit score will increase your chances of being approved for mortgages, auto loans, and even a new credit card.

A 900 credit score is also a great achievement for your bank account because it will give you access to some of the best credit cards in the market. It will also help you get the best possible interest rates on your loans and credit cards, which can save you a lot of money in the long run.